It’s no surprise that when it comes to the mortgage process, homebuyers have come to expect the worst. Mountains of paperwork and invasive phone calls, mandatory on-site signatures… And a drawn out, daunting experience that, as it exists today, does not ensure that borrowers are getting the best possible deal when it comes to saving the most money.

Should that be the standard with literally the biggest purchase you’ll ever make? Of course not—enter Morty.

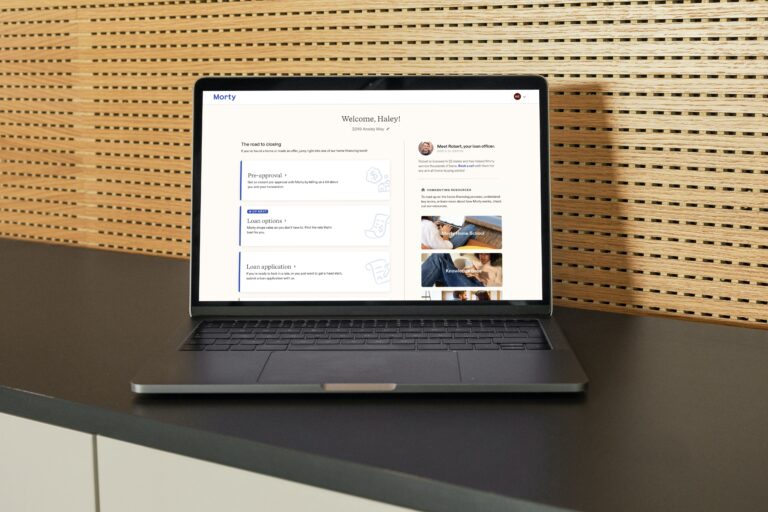

At Morty, our main mission is to empower homebuyers by giving them access to a wide network of lenders and products and allowing them to shop and compare all of their options before committing to one.

So how does Morty’s digital mortgage experience hold up for our borrowers? Scroll down to read for yourself—we’re sharing the first installment of our Borrower Stories—a series where homebuyers who’ve used Morty summarize their custom tailored, modern mortgage online experience.

Nick and Allison, homeowners in Richmond, VA discuss the factors that went into buying their home, as well as using Morty’s technology to shop and compare their different loan options.

Morty: What were the deciding factors that went into becoming a homeowner?

Allison: We knew we wanted to move away from the hustle and bustle of Northern Virginia and the high cost of living, and Richmond, VA was just the place we were looking for. A bunch of factors went into us becoming homeowners: investment, tax breaks, diversify portfolio, stability—moving is a pain and with a fixed mortgage, there are no rent increase surprises. Also, being able to make it your own—adding a wine cellar or outdoor entertaining space without landlords’ approval.

Morty: Obviously a home is the biggest purchase you’ll ever make. How did you know you’d found the right home and what were the emotions or next steps leading up to that purchase?

Allison: For us, it was a feeling.. especially for Nick. He knew exactly what he did and didn’t want. It was under budget, which would allow us to explore our new city more AND travel more. After signing the contract, we were very excited and ready to start our new venture in Richmond. It really hit everything on our wish list: privacy, backyard, a sense of community, an open kitchen, a “man cave,” and most important—levels! Nick and I both work from home. He’s in finance, I’m in sales. Our offices needed to be on different floors.

Morty: What had you heard about the process of getting a mortgage? What were your expectations?

Allison: “The process” is what I feared the most, and definitely kept me from becoming a homeowner sooner. I travel a lot for work and from what I heard, [getting a mortgage] was time-consuming, repetitive and frustrating. Lenders would want to meet in person, drill into my past, and request the same information over and over. Thankfully, by word of mouth, I found out about Morty.

Morty: What was your actual experience like using Morty?

Allison: Like booking a flight through Kayak. The process was almost completely done online, which fit my lifestyle. The interface was user-friendly, to the point and “very 2017.”

What was the best thing about working with Morty overall?

Allison: Being a first-time homebuyer, I had a TON of questions. Morty made me feel at ease. Although the majority of it was done online, [my Morty expert] was very knowledgeable and took the time to answer all my questions explaining the different rates and percentage points while comparing conventional loans and what my return on investment would look like in 5 years.

Morty: If you could give one of your friends (or anyone) who is going into the home buying process any advice based on your experience, what would it be?

Allison: Don’t listen to your parents on their “home buying process.” Times have changed and Morty recognizes that. I’d highly recommend using Morty; the process is conducive to our lifestyle and the Morty experts are knowledgeable, patient and can really save you money.

Morty: How do you feel the home buying process is going to change for Millennials versus your parent’s generation (based on what you know or heard)? What do you think the benefits of that are?

Nick: I think the mortgage industry—not to mention all industries—will eventually convert to the online process because it requires less paperwork and saves a lot of time. Our parents’ generation is generally not as trusting of “online,” but here we are using Venmo and trading Bitcoin. I’m sure most parents still use checks to pay with cash.

Allison: Morty is an innovator. Upcoming homebuyers are Millennials, they need a process (and a platform) that fits their lifestyle. Everyone dreads going to the DMV—too much paperwork: forms, outdated processes and overall, time-consuming. That’s how I envisioned the home buying process, but [I] was pleasantly surprised and blown away by Morty!