What homebuyers should know as 2022 comes to a close

It’s certainly been a volatile year for the housing and mortgage market. In January, rates hovered just above 3%, sustaining high demand from buyers. But in March the Federal Reserve began a series of rate hikes that have continued throughout the year. Mortgage rates rose higher in turn, eclipsing 7% in October to reach their highest levels in over 20 years.

While predictions swirl about the coming months and year ahead, the truth is that things remain highly uncertain. At this time last year, few experts were predicting mortgage rates to hit 5%, let alone the levels we’ve seen over the past few months. While we don’t have a crystal ball, we can help you approach the market with confidence and knowledge. Here are three things to keep in mind as we head into 2023:

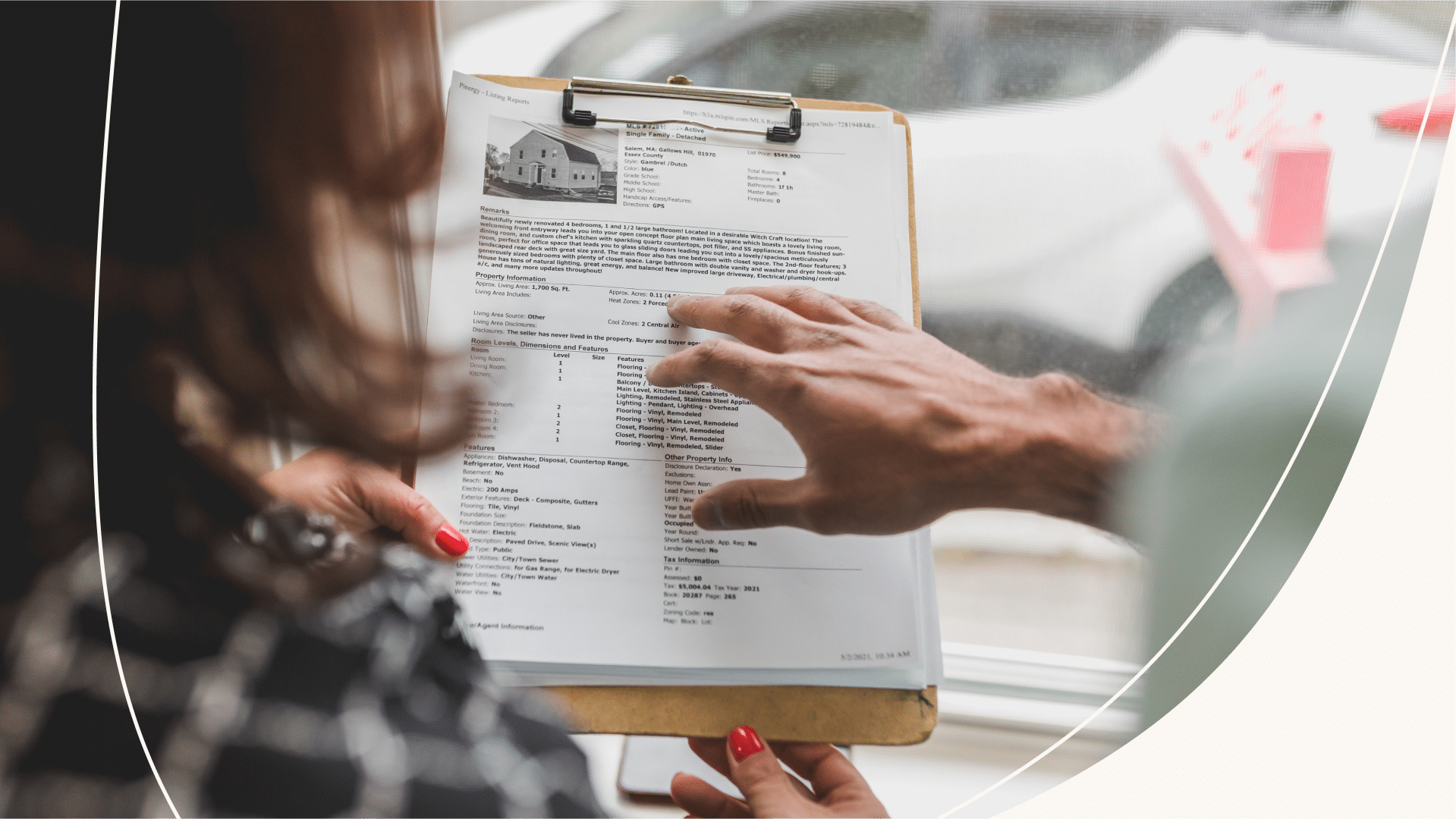

1. Get to know the neighborhood

Whether you’re looking to buy in your neighborhood or somewhere new, knowing your specific market can give you a leg up. Research recently sold properties that match your needs to see how long they were on the market and what price they closed for relative to their list price. Partnering with a knowledgeable real estate agent you can trust is important, but being a well-informed buyer can save time, help you decide which properties are right for you, and ensure you’re asking the right questions.

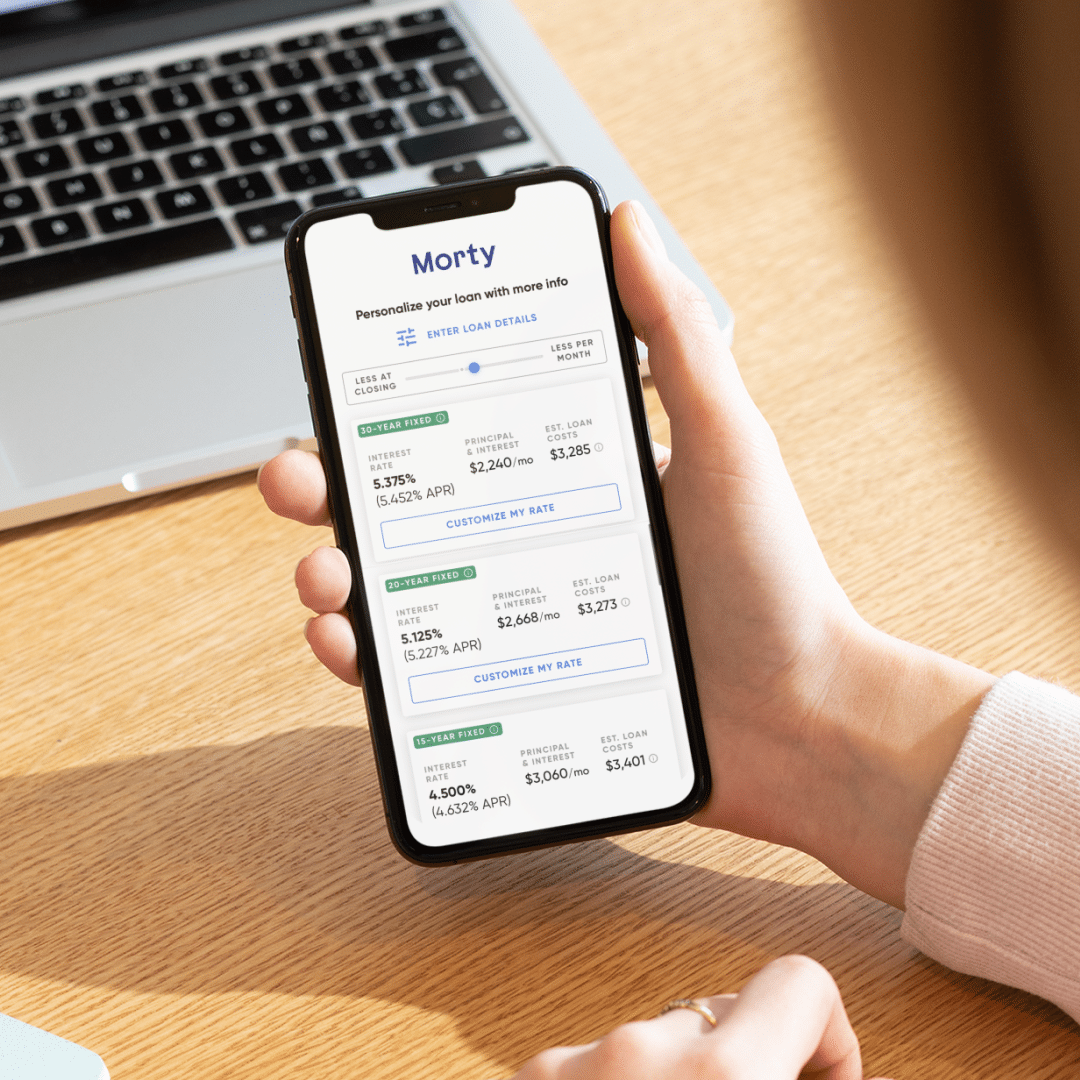

2. Put your bottom line above the headlines

While 2022 was volatile, there have been many dire predictions and warnings that were overstated. Higher rates, decreasing affordability, and high prices may make you skittish, but your own financial situation is the most important factor in whether to buy or not. Understand your credit score, savings and any debt, get pre-approved early on, and shop around for mortgage options to get a full sense of what you can afford.

3. Test the buyer’s market

While declining affordability points to the impact of higher rates it also means sellers could be more amenable to price cuts, negotiating, or agreements like buydowns. If you can afford to buy now, your chances of getting the home you want could be far better than a year ago, so don’t rule it out.

– Robert Heck, Vice President of Mortgage @ Morty