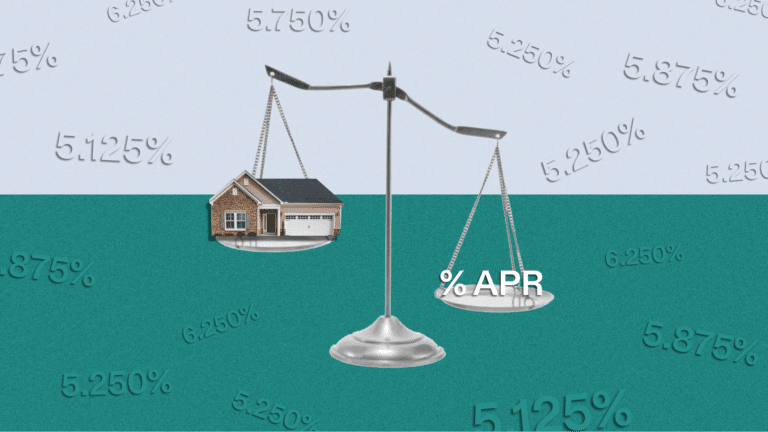

Rates are volatile this week, heading up mid-week after dropping for two weeks in a row on the heels of some positive inflation data. Recently released minutes from the Fed’s June meeting point to further steep rate hikes and reflect inflation’s continued impact on monetary policy.

This comes as recent data shows the size of purchase mortgage applications dropping down to $413,500 from $460,000 in the spring. This doesn’t necessarily mean home prices are going down (price growth is likely to continue even if it levels off), but it suggests that buyers continue to see opportunities even at elevated rate levels.

In spite of the impact of rising rates on affordability over the past several months, there are a number of options worth considering when it comes to accessing the market, from government-backed loans to conventional programs such as HomeReady, or even adjustable-rate mortgages (ARMs).

– Robert Heck, Vice President of Mortgage @ Morty

A CLOSE YOU CAN COUNT ON

We’ll make your closing date—or you get $2,000

Read more of Robert’s recent insights:

In case you missed it

- To understand where we’re going with rates, it’s good to understand where we’ve been. Here’s a look at historical mortgage rates from the 1970s, onward.

- It’s a tough market for many homebuyers right now – here are five tips to help you navigate a competitive market.

- We now have new loan options with even more competitive pricing on loan amounts between $100,000 and $300,000. Get started with your personalized loan options.