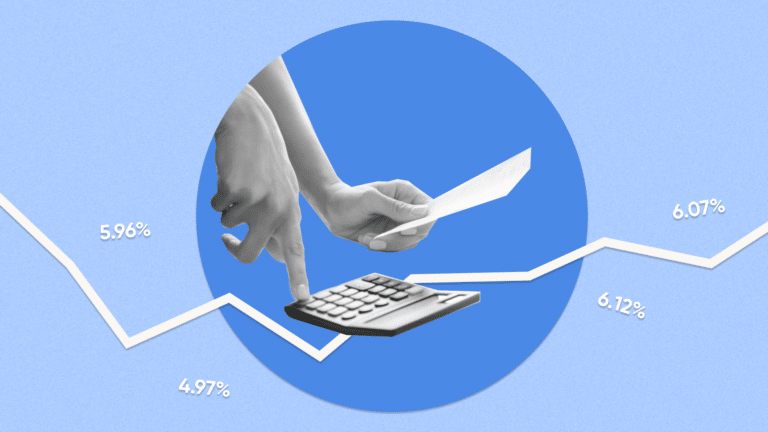

Some mortgage rates crept above 6% this week, as the market reacted to higher-than-expected inflation data and sought to price in anticipated rate hikes coming out of this week’s Federal Reserve meeting. With that, we’re teed up nicely for this week’s reader question…

-Robert Heck, Vice President of Mortgage @ Morty

Not sure what to do? We can help! Drop us a line on Twitter @himorty or email MortyReport@morty.com.

Reader Question of the Week:

How quickly will we see a change in mortgage rates after a Federal Reserve meeting?

– Mel C. in Broomfield, CO

There’s a common misconception that you’ll see a dramatic spike or fall in mortgage rates in direct response to Fed announcements. In reality, the mortgage market is adjusting daily to macroeconomic conditions and predicted policy changes by the Fed. This means that any expectations of rate hikes typically get priced into the market well in advance of the announcements themselves. So we’ll see some rate movement – but likely nothing crazy.

After the Fed’s May meeting, we actually saw rates stabilize and drop off slightly, though they had been gradually ticking upward in the weeks before it. As for what will happen to rates following this week, you can expect some volatility as the market settles in. Buyers should look for signs of decreased demand and increased inventory in the housing market as inflation continues to surge and fuel general economic uncertainty.

Get the full Morty Experience

Get pre-approved in a flash, gain access to your downloadable quote, and take advantage of our unique Closing Programs when you create an account. It only takes a few minutes!