The market is changing quickly, as the Fed raises rates again

This week, the Federal Reserve met and issued another interest rate hike as it works to bring the rate of inflation back to 2% (it came in at 8.2% in September). For homebuyers, rate hikes have contributed to volatility in the secondary mortgage market (where mortgages are bundled and sold as securities), helping to drive mortgage rates higher over the past several months. At the end of October, 30-year fixed rates eclipsed 7%, their highest level in over 20 years.

With the volatility we’ve seen this year, it’s difficult to say whether we’ve hit a ceiling or to say how things will move from here. Economic uncertainty remains, with headlines around a looming recession and layoffs leaving many understandably skittish. Would-be buyers and sellers are also still adjusting to the whiplash that comes from transitioning quickly from a hot market to the more limited activity we’re seeing now. Those considering jumping into the market should keep in mind that while low inventory means fewer properties to choose from, there could be some opportunities with less competition and sellers that are more amenable to price cuts.

– Robert Heck, Vice President of Mortgage @ Morty

What Do Buyers Need to Know?

Focus on Affordability: While there’s no question that rates are high, this doesn’t automatically mean it’s the wrong time to buy. It really comes down to what you can afford to buy right now and how that intersects with your homeownership goals. This may be especially true if you’re looking to stay in your home for a longer period of time. Building equity in a home, even if rates are high or you can’t afford as much as you could have last year, could still be helpful when it comes to building wealth long term.

Don’t Panic: There’s no question that things have changed since earlier this year, but it’s unlikely that we’re headed for a housing crisis that’s comparable to what we saw in 2008. Fundamentals remain different, and we’ve still yet to see significant price drops aside from certain markets that were highly inflated during the pandemic.

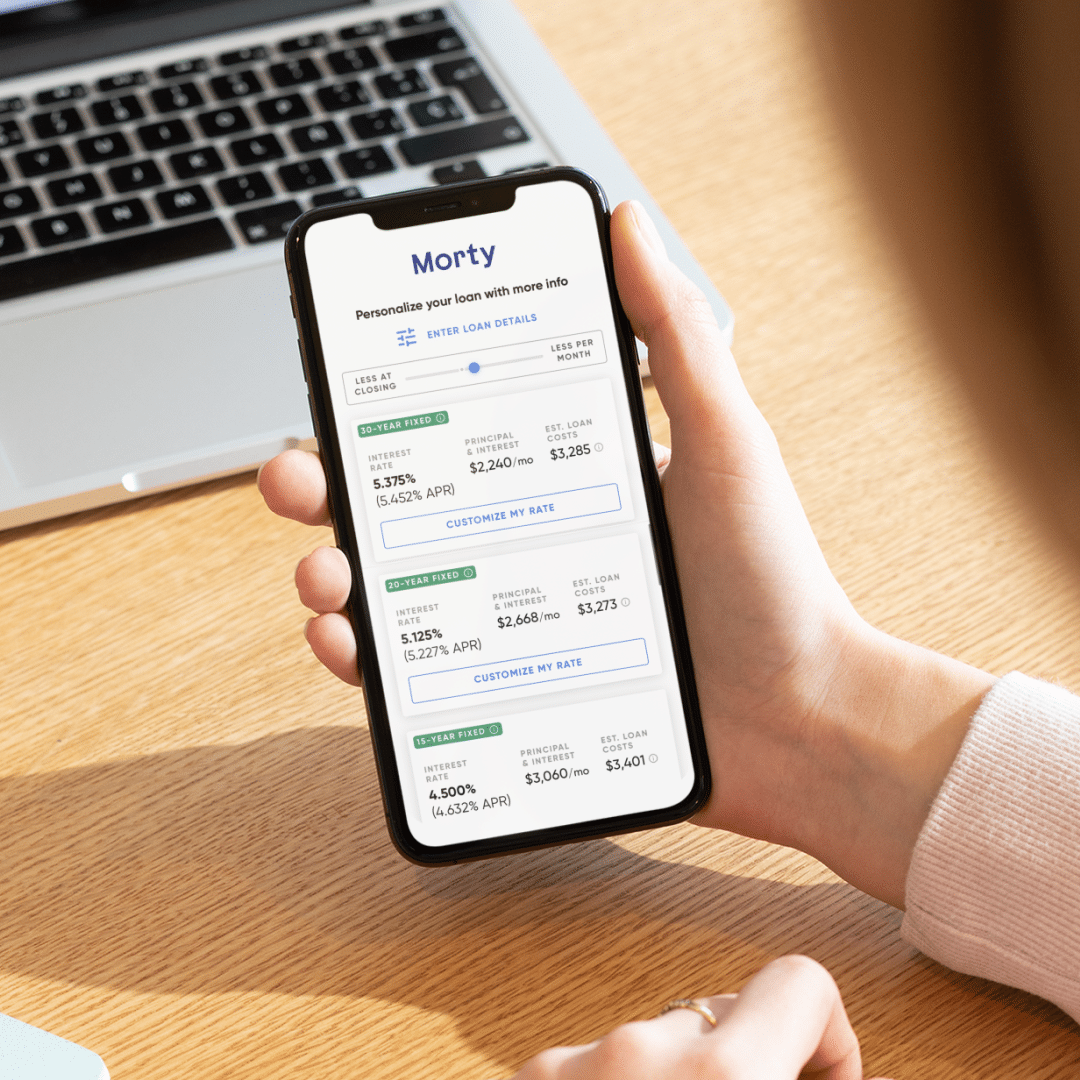

Know Your Options: If you are considering buying, it’s more important than ever to understand the wide range of options that can help make the market more accessible. Explore different types of loan options, from conventional, low-down payment options like HomeReady, to FHA loans with lower credit score requirements. Depending on your individual financial situation, it could also be worth looking into affordability tools such as rent-to-own and buy-before-sell.

A bit of history

Mortgage rates hit their highest annual rate in 1981, when they stood at an average of 16.63%, according to a recent study by Rocket Mortgage of Freddie Mac data. While rates seem high now, and they’re certainly much higher than the 3% rates we saw just a year ago, it’s important to keep things in perspective.