January is looking brighter for homebuyers

Newly released data shows the Consumer Price Index (CPI) rose 6.5% annually, reflecting a dip in the inflation we’ve seen over the past year. While inflation remains elevated, this marks two months of positive signs.

So what does this mean for homebuyers? On the whole, a few moderately positive indicators and a lack of any bad economic news have helped drive down mortgage rates. This is a good sign for those who are in the market now or anyone might have been waiting on the sidelines for rates to fall further away from their late 2022 highs.

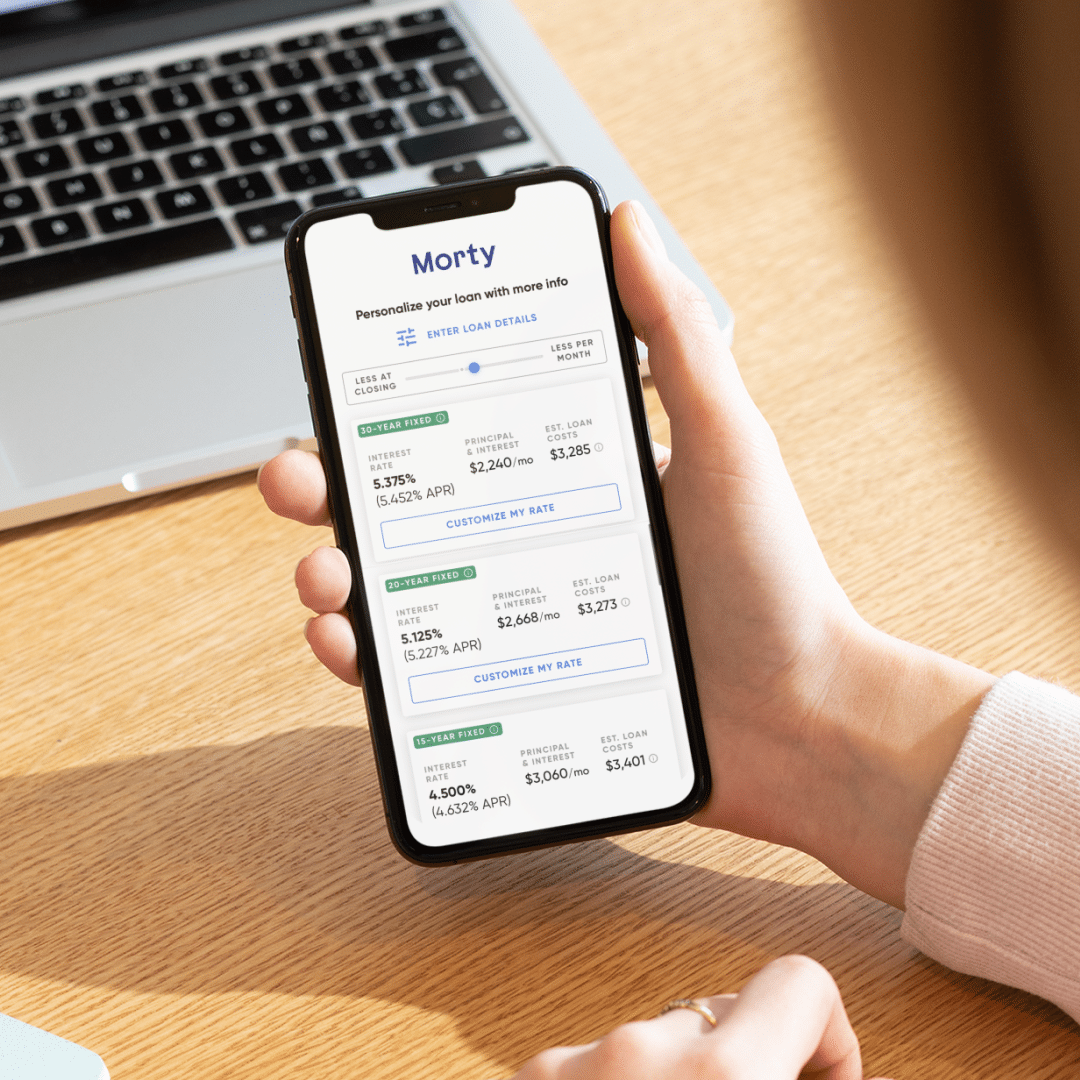

In addition, Fannie Mae’s National Housing Survey showed a 5% increase in the number of respondents who believe that now is a good time to buy a home. While the figure is still low at 21%, the increase points to a gradual increase in confidence as prices soften. A focus on affordability remains, with homebuyers continuing to leverage tools like buydowns. Check out our Q+A on buydowns here in case you missed it.

– Robert Heck, Vice President of Mortgage @ Morty

Have questions about the market? Drop us a line on Twitter @himorty or email MortyReport@morty.com. We’ll happily answer your questions and even connect you with our team of experts if you need more assistance.

Reader Question

“If I’m already pre-approved, but not quite ready to make an offer yet, how do I know when it’s the right time to lock my rate?” – Olivia O., Arlington, Texas

Typically, you’re able to lock your rate once you have a signed purchase agreement, so it in part comes down to your own individual home search. That said, there are a few steps you can take to make sure you’re getting as competitive and flexible a rate as possible.

Typically, rate locks provide homebuyers a standard window (usually between 30 and 60 days) within which to close on a property at the agreed-upon rate. However, there are a variety of lenders that can offer extended rate lock periods of up to 180 days, including those in Morty’s marketplace. These extended rate locks allow you to solidify an interest rate during that window.

There are also lenders and programs that offer TBD locks, where you are able to lock a rate without a property, and float down options, which will lock in a current rate with the ability to lower it if rates drop – this can be extremely valuable in a volatile mortgage rate environment. If you’re buying a new construction home, there are programs that can offer even longer extensions.