Inflation shows some improvement, but how does it impact homebuyers?

This week, the Federal Reserve raised interest rates again, this time by .5%. While an increase is still an increase – interest rates now sit at their highest levels since 2007 – it’s lower than the .75% rate hikes we saw at the last four Fed meetings, stretching back to June. The move also comes on the heels of recently released consumer price index (CPI) data that showed lower than expected price increases.

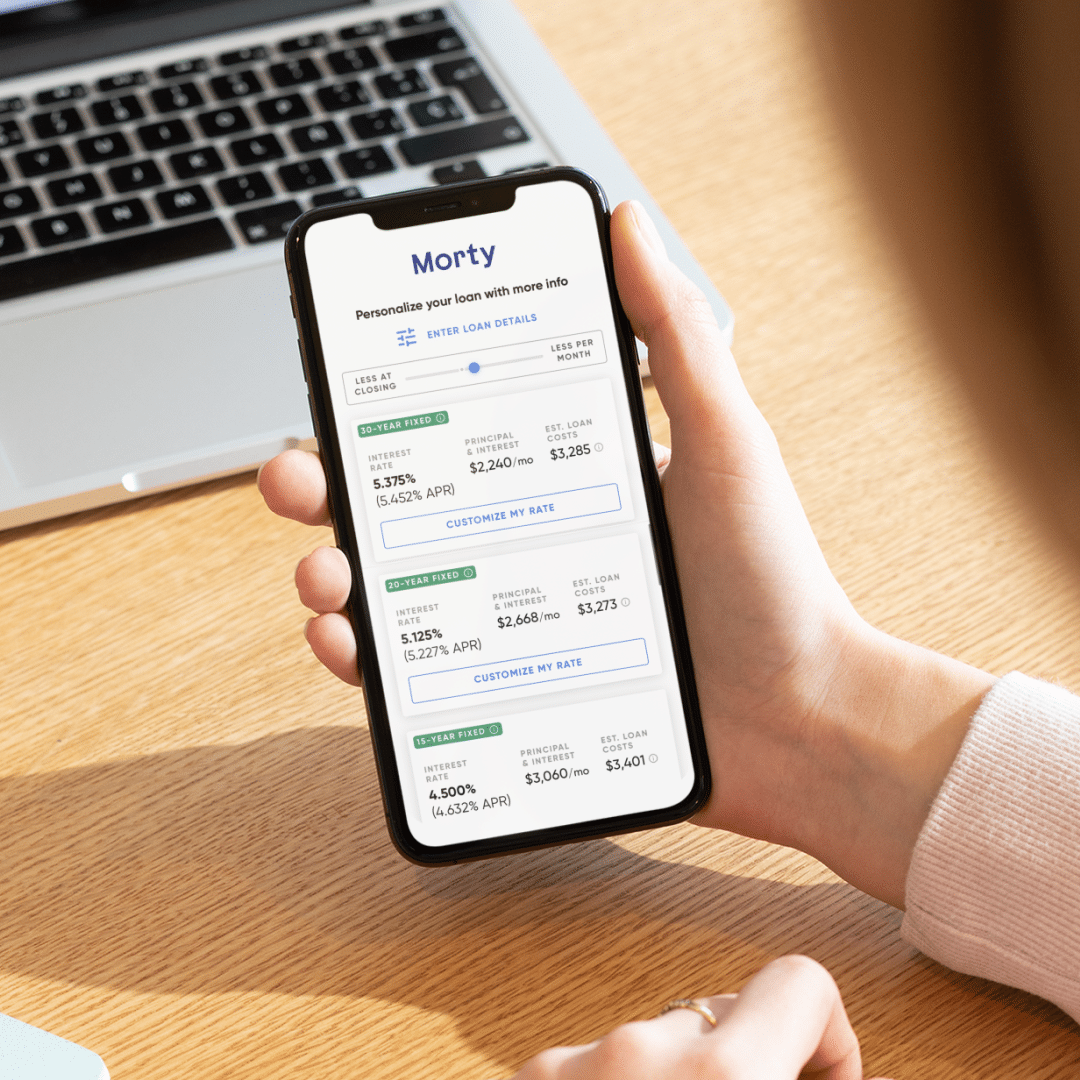

While inflation remains a problem, these are positive signs that it’s improving. Mortgage rates have also been improving over the past few weeks — in Morty’s marketplace, we’re seeing rates for 30-year fixed-rate mortgages hovering around 6.1%, down from nearly 7%, in earl November. There could be more opportunities for buyers if competition remains thin and they can take advantage of recent rate improvements

If you’re in the market right now, or thinking about jumping in, there are some tactics you should know about. See below for more!

– Robert Heck, Vice President of Mortgage @ Morty

Q+A – What are buydowns and how do they work for buyers?

Buydowns are a tactic we’re hearing a lot about in the market right now. A buydown is when a buyer receives a lower rate for a set period of time in the beginning of the life of a loan, usually the first few years. This is achieved through a fee paid by the seller to the mortgage lender in exchange of the lower rate. Buydowns are most commonly offered by developers to buyers of newly constructed properties, but we’re seeing them in other transactions as well, as some sellers look to provide greater buyer incentives.

Two common types of buydowns:

- 3-2-1 – A buyer receives a lower rate for the first three years of a loan, with the rate increasing by 1% each year until the full rate becomes active in the fourth year.

- 2-1 – A buyer receives a lower rate for the first two years of a loan, with the rate increasing by 1% each year until the full rate becomes active in the fourth year.

Buyers should keep in mind that a buydown is different from purchasing points, which can also decrease their interest rate. Buydowns are typically better suited to buyers who plan on being in a home for a shorter period of time, but all buyers should be sure that they can afford the loan at the full interest rate that will eventually take effect.