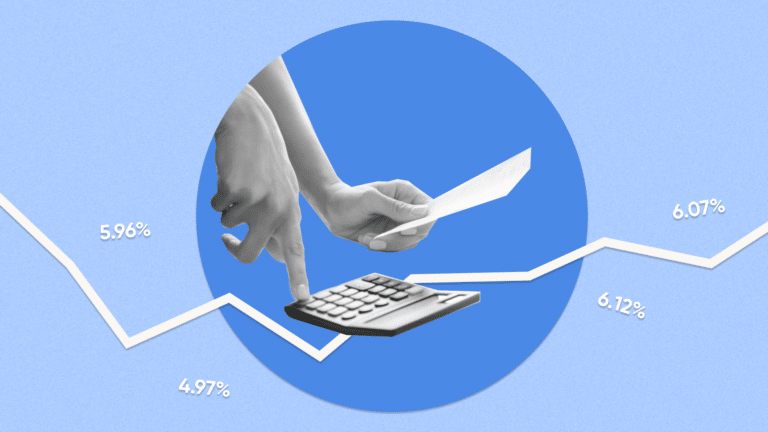

Market forces push and pull on mortgage rates

The combination of the Fed’s efforts to combat rising inflation and uncertainty in the banking sector are having a push and pull effect on mortgage rates. This week the Fed raised the Federal Funds rate by .25%, making it nine rate increases in a row.

While the Fed’s move was largely reflected in mortgage rates already, uncertainty remains around future hikes, which could influence rates going forward. While the Federal Funds rate doesn’t directly determine mortgage rates, the Fed’s actions impact the yield on US Treasury bonds, which in turn influence mortgage rates. On the flip side, turmoil in the banking sector has contributed to macroeconomic uncertainty and could lead the Fed to limit further hikes.

This environment does present opportunities for buyers who shop around and evaluate a full range of options. We’re also seeing prices drop off in many markets and home builders offering incentives. Buyers should focus on structuring their loan options to best reflect their own goals in terms of price, upfront costs and the amount of time they plan to spend in a home. Remember that getting the lowest rate won’t necessarily provide the best terms in the long run.

While anything is possible (especially after the last year) rates are likely to remain in this range for the foreseeable future, and all eyes will be on further commentary for the Fed. But open houses may be looking a bit more crowded this weekend, with mortgage volume increasing as buyers head back into the market.

-Robert Heck, VP of Mortgage

In The News

Being informed around the state of the market has never been more important. Here are some top stories from this week.