Why ‘deal’s off’ is a big deal for buyers.

Last month, nearly 15% of purchase agreements in the U.S. fell through before closing – a possible signal that buyers are gaining more negotiating power amid the market slowdown, according to a Redfin analysis.

While buyers may be less likely to waive inspections and appraisals in the current conditions, the data also underscores ongoing housing affordability challenges amid higher rates and rising inflation. If a small shift in rates means you can no longer afford to buy, you may want to revisit your budget and consider your overall financial profile.

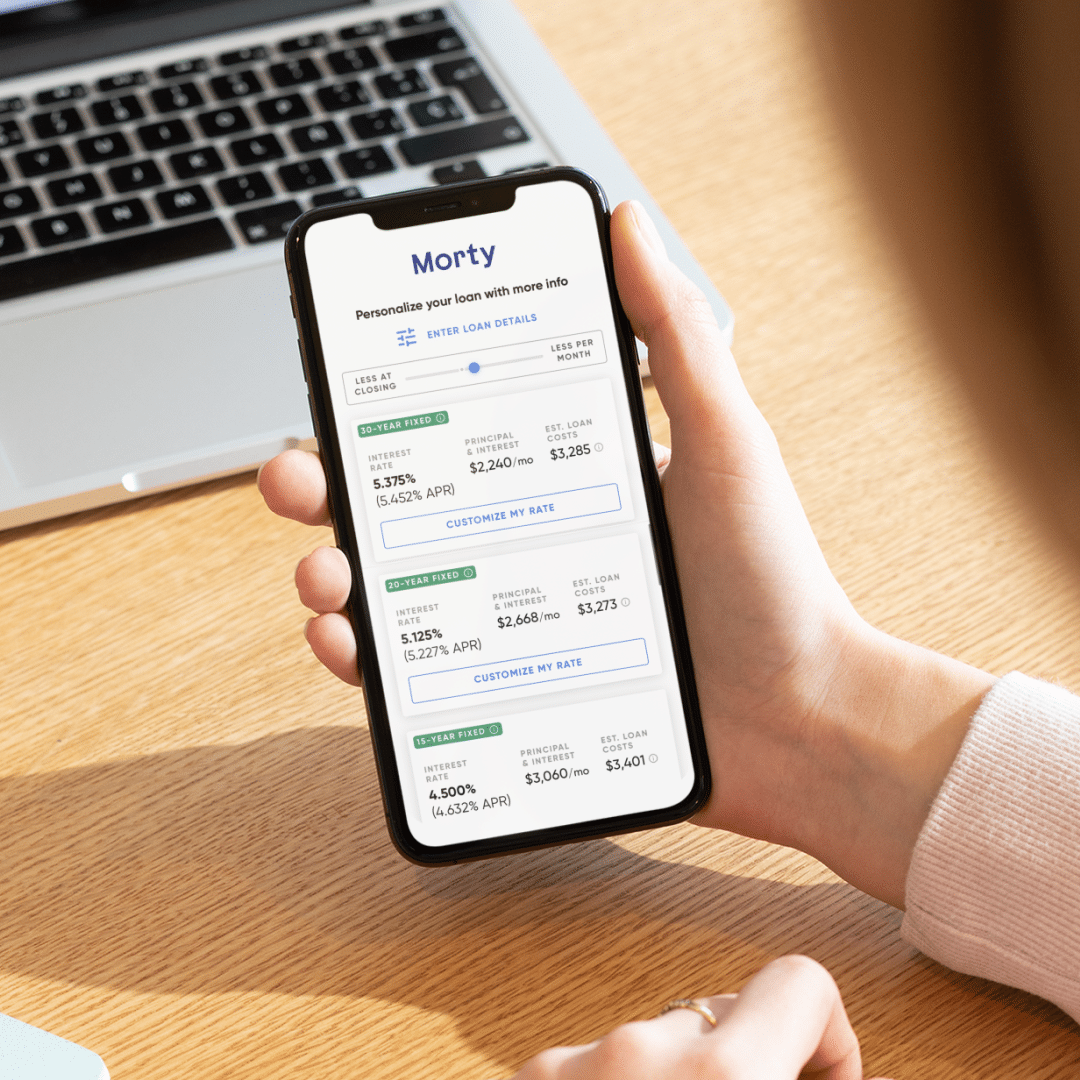

In an environment where rates are changing quickly, you might consider loans with longer rate-lock periods (lenders in Morty’s marketplace offer 180-day options) and TBD locks (where you can lock before going under contract). Adjustable-rate mortgages (ARMs) remain a good option to consider if you’re looking for a lower upfront rate. More on that below.

– Robert Heck, Vice President of Mortgage @ Morty

All About ARMs

We recently spoke with the Wall Street Journal about a few scenarios when an ARM might be a good fit for homebuyers. Here’s what our team of mortgage experts had to say:

Moving on quickly?

ARMs can be an attractive option if you don’t plan to live in your home for more than a few years. It’s also worth considering if your priority is locking in the lowest possible rate upfront.

Why now?

Rates remain volatile amid ongoing economic uncertainty. ARMs can offer a lower upfront rate during the fixed-rate period before the rate becomes variable. And while not guaranteed, you can also look into refinancing your home before reaching the adjustable-rate period.

What are the risks?

ARMs aren’t for everyone – they’re a more complex option than a fixed-rate mortgage. Be sure to research whether they make sense for your situation, and make sure you’re comfortable with the risks of future market volatility. Your ability to refinance is also dependent upon market conditions.

Not sure what to do?

We can help! Drop us a line on Twitter @himorty or email MortyReport@morty.com