Plenty of individuals depend on tips to support some or all of their earnings.

This trend is especially prominent in the service and hospitality sectors, where millions of Americans work and rely on gratuities as a significant part of their income. The prevalence of such roles is expected to grow in the next decade.

Contrary to common belief, buying a home is not limited to those with traditional desk jobs or salaried positions. In fact, numerous servers, bartenders, blackjack dealers, and Uber drivers achieve homeownership every day.

However, purchasing a home with tipped income involves specific considerations. The good news is that qualifying for a mortgage with substantial tipped earnings is attainable.

If you fall into the category of millions who receive a major portion of their income as cash after each shift, pay attention. This article provides essential insights into buying a home as a tip-earning worker.

Related: The key differences between mortgage brokers and mortgage lenders

1. Prepare Your Proof of Income: Essential Tips for Homebuying as a Tipped Employee

Mortgage lenders don’t really care much about how you earn a living. Dog walker? Showgirl? Professional balloon artist? Cool.

How you make your money is not that important.

How much money you make is.

Mortgage lenders want to be reasonably sure that you can afford to make your future mortgage payment every month. So lenders take income verification very seriously.

Hourly wage-earners and folks with salaried jobs can use their paystubs to help verify how much they earn. But if your employer isn’t tracking all of your earnings for you, then you’ll need to document the money you’re bringing in yourself.

(In the past, it was possible to secure a mortgage by just stating your income. But we’ll-take-your-word-for-it mortgages were part of the trouble that led to the 2008 housing crisis. So now, everyone’s got to back up their income claims with proof.)

Tracking your tip earnings in a notebook or with a spreadsheet is a good idea. That said, your future mortgage lender is going to trust your banking records more than the Moleskine in your pocket.

So make a habit of depositing all of your tips into your bank account. Resist the urge to spend any cash tips before you have a chance to put them in the bank. Is it annoying to track every last penny you earn? Or to put money in the bank before pulling it back out? Maybe. But having good records for your income is important. (More on those bank statements here in a bit.)

2. Tax Compliance for Tipped Employees: Navigating Homebuying and Uncle Sam

Fact: when you apply for a mortgage, lenders will be taking a good, hard look at your tax returns.

Now, we definitely don’t know any servers or bartenders who maybe underreport their tip earnings to try and save a few bucks come tax time.

We’re sure you don’t know any folks like that, either.

We will say, though, that if you’re thinking about buying a home, you will want to make extra sure that all of your income—including your tips—is being reported to the IRS. You want to make sure your personal records, your bank statements, and your tax filings all tell the same story about how much money you earn. Trying to convince your mortgage lender that your real earnings are actually much higher than you reported to the IRS isn’t going to help your case for getting financing for a home.

Also, it’s not wise, generally, to lie to the IRS. Audits are a pain, penalties are stiff, and jail time is a real possibility, even for relatively low-level tax evasion.

3. Stability Matters: Avoid Sudden Changes When Buying a Home as a Tipped Employee

As we’ve mentioned, mortgage lenders want to see proof of how much money you earn each year. But! Lenders also want to feel pretty sure that you’ll continue to earn roughly the same amount of money, consistently, in the years to come.

Generally, mortgage lenders want to see that you’ve had the same employer for at least six months. They’ll also feel better about approving your mortgage if you haven’t made any sudden career changes in the last two years or so.

So, let’s say you’ve held the same restaurant job for the last five years. You earn a little more now than you did when you first started, but nothing crazy. And your bank statements and personal records show that your tips only vary about 10% month-to-month. That’s pretty consistent. That’s the kind of work history mortgage lenders like to see.

Now, imagine instead that you’ve had six serving jobs in the last five years. Or that you earned half as much last year as you did the year before.

In those cases, you’re going to have a much tougher time convincing a mortgage lender that you’re up for honoring a decades-long financial commitment.

4. Secure Your Finances: Why Checking Bank Statements is Crucial for Tipped Homebuyers

As a part of verifying your assets, mortgage lenders ask to take a look at your bank statements. And if you’re a tip earner, your bank statements will probably have plenty of cash deposits.

For folks with salaried jobs and regular paychecks, lots of weird cash deposits are a red flag. Cash coming in that can’t be traced can indicate unreported or illegal sources of income, under-the-table loans, or other shady business. So mortgage underwriters look very carefully at cash deposits.

But of course, you are a smart tip earner. And you know that lenders will trust your bank statements more than your personal ad hoc spreadsheet. If you’ve been carefully depositing tip money instead of spending it willy-nilly, you may well be making multiple, legitimate cash deposits every week.

So here’s our advice. In the months leading up to your mortgage, keep a detailed record of where each of your cash deposits came from. Print out your shift schedule, and keep it somewhere safe.

When you deposit tips into your bank account, make a note for yourself about how much you earned per shift, and which deposits go with which dates. You don’t need anything fancy for this. But when a mortgage underwriter asks about the cash deposits, you’ll be ready to provide documentation.

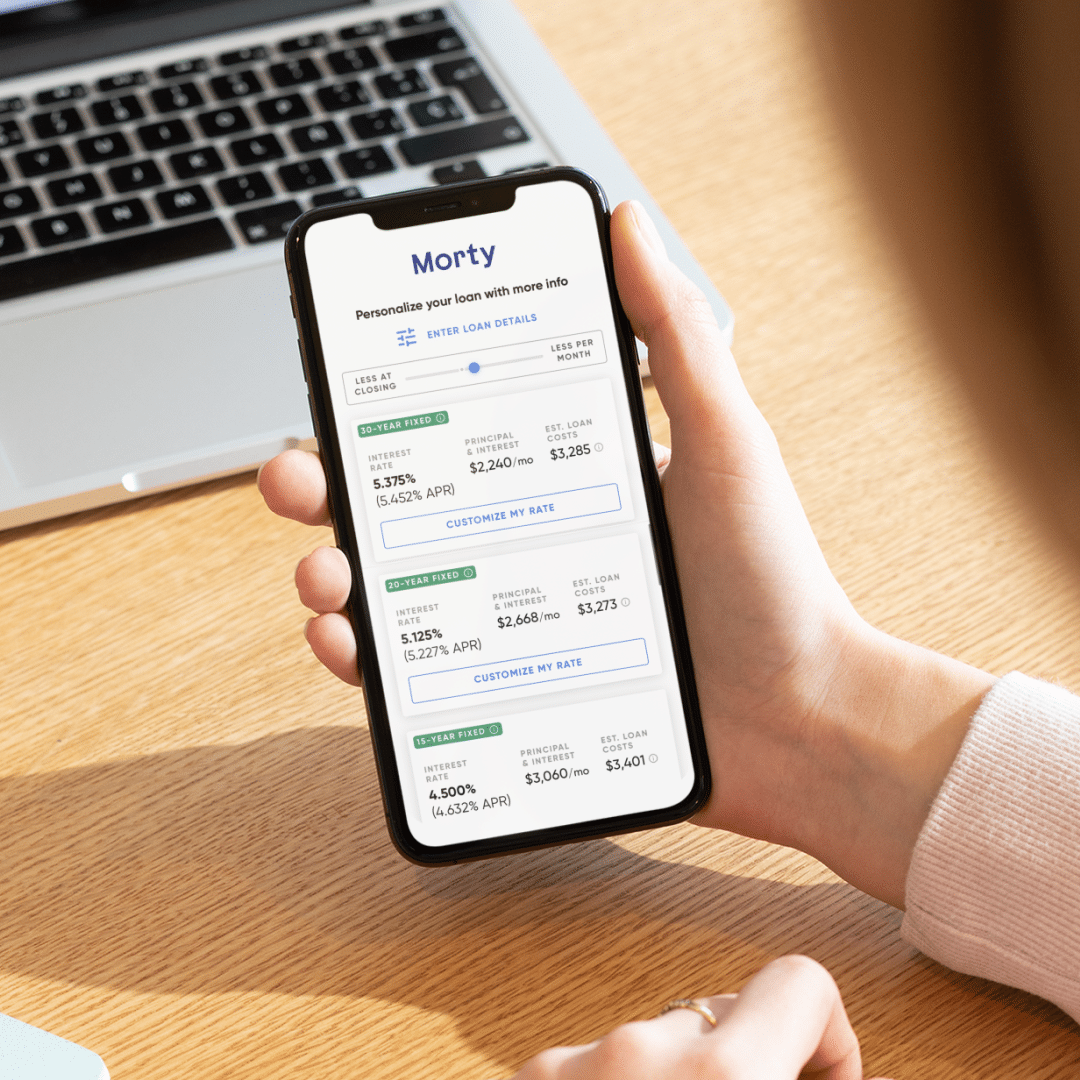

Morty helps homebuyers navigate the home buying process and secure financing to buy their first home. We work with our homebuyers through the entire home buying process, from pre-approval to closing. If you are ready to become a homeowner, get started with personalized loan options.