When shopping for your mortgage or refinancing your mortgage, one of your top-of-mind questions probably sounds a lot like: “What will my monthly mortgage payment be, and how will it fit into my budget?”

Your loan amount, principal, interest, term and more play into your monthly payment amount. You will want to feel comfortable making your loan payments on a monthly basis, so put some thought into these calculations.

We’ll go over all of the components needed to calculate your monthly mortgage payment in more detail. We’ll also show you how to do it all by hand—for those of you who aren’t a fan of algebraic equations, don’t start to sweat. We’ve included a few simpler methods as well.

What is a Mortgage Payment?

At a basic level, you know the definition of a mortgage payment: the amount of money you pay toward your mortgage each month.

But you may be wondering, what exactly is included in a mortgage payment?

The four ongoing components of mortgage payments include the following: principal, interest, taxes and homeowners insurance. You may also pay mortgage insurance as part of your payment as well. Let’s take a look at each component.

- Principal: Mortgage principal refers to your loan balance, or the amount you have left until you pay off your loan. For example, if you borrow $200,000 to buy a house, the principal amount is $200,000. Let’s say you’ve paid off $150,000 of your loan balance. Your principal amount would now be $50,000. The principal payments you make over time reduce the amount you owe.

- Interest: Your mortgage lender charges you for borrowing money in the form of interest. The amount you pay in interest per month depends on the interest rate you get from your lender.

- Taxes: Taxes are part of your mortgage payment. A third party holds these funds in an escrow account. Your mortgage servicer then pays your taxes when they are due. Property taxes pay for local government needs, such as school districts, street upkeep and local fire and police protection.

- Homeowners insurance: You will need homeowners insurance when you have a mortgage. It covers loss and damage to your home due to fire, wind, theft or other hazards. Part of the money held in your escrow account goes toward your homeowners insurance.

- Mortgage insurance: You may need to pay mortgage insurance as a part of your mortgage payments — but not everyone has to. Mortgage insurance protects your lender in case you stop making payments on your mortgage. If you make a down payment of less than 20%, you’ll pay for private mortgage insurance (PMI).

If you get an FHA loan backed by the federal government, you will also pay a mortgage insurance premium (MIP) throughout the life of your loan. MIP would also roll into your monthly mortgage payments.

How Do I Calculate My Mortgage Payment?

Your individual mortgage payment depends on several variables, including three main variables for the actual calculation itself: the principal, interest rate and number of payments in your loan term.

To use the formula correctly, you must use the original principal balance and your base interest rate — not the annual percentage rate (APR). APR includes interest rate, points, mortgage broker fees and more.

You want to include the number of payments in your loan term. Your loan term refers to the number of years you and your lender have agreed you will pay off your mortgage. You can determine the number of monthly payments in your loan term by multiplying by 12 (the number of payments you make per year). In other words, if you have a 30-year mortgage, you’ll make a total of 360 payments.

Formula for Calculating Mortgage Payments

Once you nail down all the information you need to calculate your mortgage payments, you can use the following formula:

Due to the complexity of this formula, you may want to use a digital mortgage calculator instead of calculating your mortgage payments yourself. Mortgage calculators can easily churn out accurate figures.

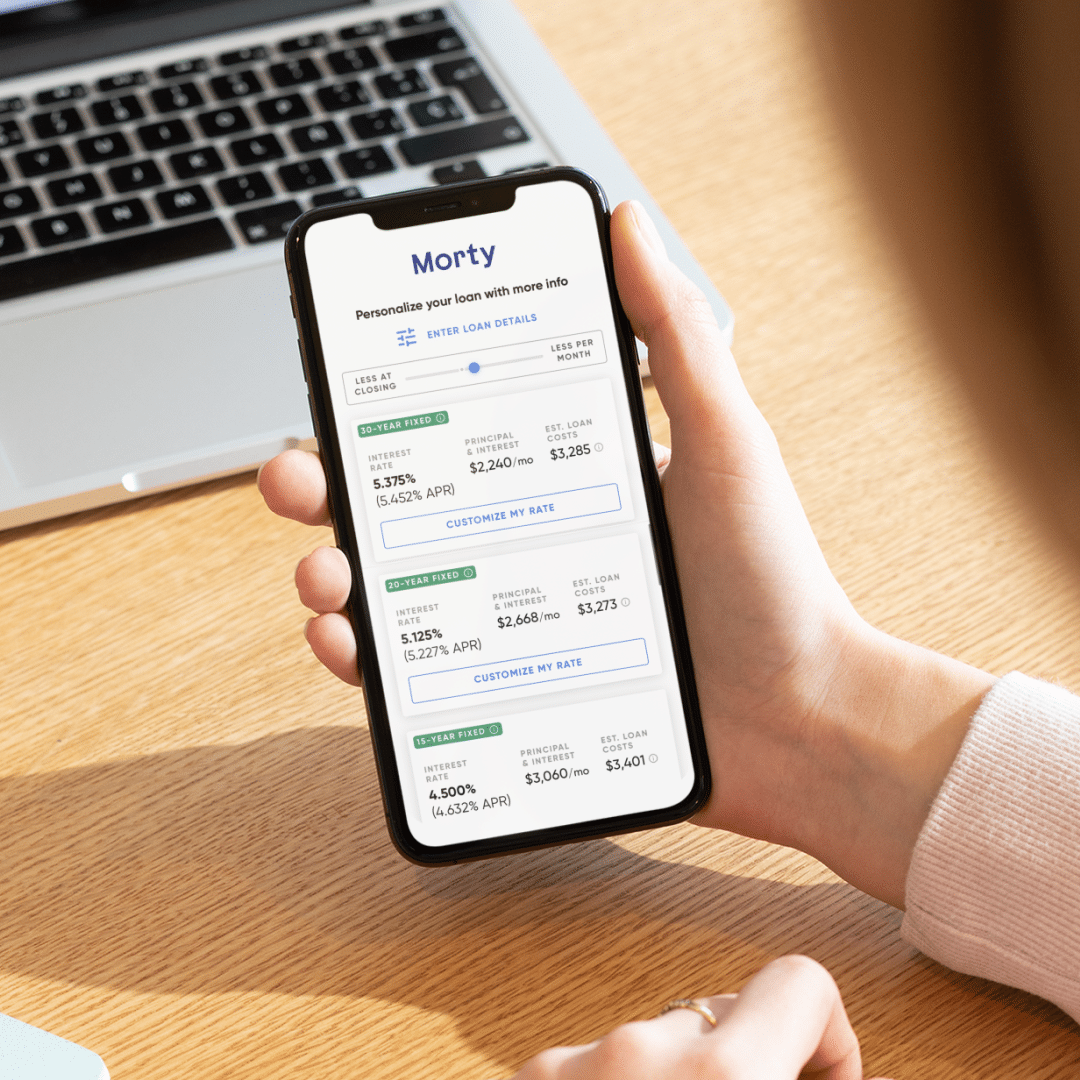

Types of Mortgage Calculators

If you’d rather use a mortgage calculator to do the hard work for you, you can look into several different options: purchase calculators, refinance calculators and amortization calculators.

Purchase Calculator

A purchase calculator, or home affordability calculator, helps you estimate how much home you can afford. All home affordability calculators look slightly different, but in general, you’ll input your monthly income, expenses, and assets to get an estimate of what you can afford.

The calculator may ask you to input your:

- Annual gross income, or income not exempt from taxes

- Monthly debt payments on other debts you owe, such as credit cards

- Down payment amount

- Mortgage term in years

- Interest rate

- Property tax amount

- Homeowners insurance

- Monthly homeowners association fee (HOA), if the home you plan to buy requires you to pay fees to an HOA in a subdivision or other type of planned community

- Debt to income ratio (DTI), which compares your monthly debt payments divided by your gross monthly income. Morty’s maximum allowed DTI ratio is 43%, which is the limit for a federally-defined qualifying mortgage.

Once you’ve input the required information, a home affordability calculator can give you a lot of valuable information. Most purchase calculators allow you to adjust home price, loan amount, loan term, down payment and other factors to help you determine how much home you can afford.

Refinance Calculator

A refinance calculator can help you calculate estimated monthly mortgage payments, rate options and more. A refinance calculator might ask you to input the following information:

- Value estimate: A refinance calculator will ask for your home’s market value, which depends on the supply and demand of the market and what buyers and sellers believe your home is worth. You can use online valuation tools, use the Federal Housing Financing Agency’s house price index (HPI) calculator or hire a professional appraiser to get a value estimate.

- Current mortgage balance and payment: A refinance calculator will ask for your current monthly payment and mortgage balance.

- New loan amount: The refinance calculator will ask for your new loan amount to examine the details of your potential refinance.

- ZIP code: Calculators try to estimate your closing costs that will be added to the new loan amount. Closing costs represent the costs you pay at the closing table. Calculators often determine your closing costs based on real estate data available in your location.

- Mortgage term length: You’ll also input the number of years of your refinance. For example, if you plan to refinance from a 15-year mortgage to a 30-year mortgage, you can input that into the refinance calculator.

Note that Morty only supports certain refinance transactions. If you previously closed a home purchase with Morty, we can assist with a refinance transaction.

Amortization Calculator

What is amortization? It refers to paying a debt over time in equal installments. Part of each payment goes toward principal and interest. In a mortgage, the part that goes toward principal starts out smaller and interest payments start out larger. Gradually, the percentage that goes toward interest gets larger in fixed rate mortgage loans.

An amortization calculator shows how your payments break down over your loan term. The calculator may ask you for the following:

- Total monthly mortgage payment

- The principal loan amount

- Interest rate

- Number of payments over the loan’s lifetime

You may also be able to see an amortization schedule, which lists each regular payment on a mortgage over time.

What Can a Mortgage Calculator Help Me With?

A payment calculator can do a number of things for you when you’re thinking about buying a home or deciding if you should refinance your mortgage. A mortgage calculator can help you learn or find:

- The length of a loan term: A mortgage calculator can help you determine the best home loan term length for your needs. In other words, let’s say you’re considering a mortgage loan with a 15-year term. Using a calculator, you may realize that a 30-year term might fit your needs better because generally, you’ll make higher monthly payments with a 15-year term.

- Whether a home is within your budget: You may learn whether a home will cost too much for you. If you run a payment calculator but realize that you can’t fit the payments into your monthly budget, you may want to keep looking for a lower-cost home.

- The right down payment amount: Many calculators also ask you to input the amount you plan to put down for a down payment. For example, a mortgage calculator can show you whether you might need to pay more if you plan to pay less than a 20% down payment.

- Whether you’re ready to own a home or want to keep renting: A mortgage calculator can put everything into black and white for you. As long as you input accurate figures into a mortgage calculator, it can help you decide whether you’re ready for the responsibilities of a mortgage.

Whenever you want to learn about credit scores, jumbo mortgages and everything in between, Morty can be your trusted resource. If you’re ready to buy a home, check mortgage rates with Morty right now.